Chapter 1 Introduction

This website is periodically updated - current version: 2022-02-10

The printed version of the book (CRC Press) is available on the publisher website, or on Amazon US, UK and France

The research on sustainable finance has intensified in the past decade. This survey aims to synthesize recent academic results and models on socially responsible investing (SRI) in equity markets. The review is based on more than 900 sources (scholarly articles mostly) and is split into six thematic parts: data issues, investor preferences, link with financial performance, portfolio integration, climate change risk, and theoretical models.

The full bibliography can be accessed in the data folder of the Github repo of the book (‘bib.bib’ file), or in the last chapter of the book. Typo corrections and reference additions can be performed by pulling requests: contributors are invited to improve the content.

The online version of the book will be updated regularly and it features code chunks in R that were used to generate several figures.

For Python users, we point to a related Github project even though the scope is slightly different.

1.1 Content and target audience

This short book is a large-scale literature review on the topic of sustainable equity investing. It covers more than 900 academic sources (research articles, overwhelmingly), grouped into six thematic chapters. As such, it can serve as reference for analysts and researchers who work on environmental, social or governance (ESG)-driven portfolios. The book assumes no prior knowledge of this field, but some parts, especially the last chapter, can be rather technical mathematically.

While the sheer number of references may seem exhaustive, the survey only scratches the surface of the topic because the amount of contributions is daunting. The best round estimate on the pace of the development of the literature is roughly two serious papers per day (based on one year of compiling research output). The intellectual production on this matter is such that surveying a narrow subfield thereof can take weeks. In addition, all facets of the issue are interconnected, so that it does not make any sense to consider them separately. Focusing on pure ESG integration without notions in climate change risk is ill-advised. The big picture matters.

Briefly, we outline the chapters of the book below.

- Chapter 2 introduces a large number of terms to make sure the reader familiarizes with the jargon and nomenclature.

- In Chapter 3, we cover the broad theme of green investors, including their beliefs, preferences, and practices, as well as the topic of impact investing.

- Chapter 4, which is the core of the book, is dedicated to the very complex relationship between ESG investing and financial performance.

- Technical details on how to integrate sustainable criteria in complex portfolio optimization are provided in Chapter 5.

- The subject of climate change (its measurement, impact, and how to tackle it) is treated in Chapter 6.

- Finally, Chapter 7 is dedicated to theoretical models related to ESG investing and to the push for sustainability more broadly in the economy.

The review is compact, meaning that we favored concision to in-depth treatment. The monograph is intended as a thematic compass, pointing towards some relevant directions. For many topics, the interested reader will have to satisfy his or her curiosity by examining the mentioned references.

While the bulk of the book is non-technical, it is written in an academic fashion and the density of references is significantly more pronounced, compared to monographs aimed at popularization. As such, prior knowledge of notions related to ESG investing can prove helpful, even if we cover many of them along the way. Consequently, the readers who will most benefit from this work are professionals who work in the field of corporate sustainability and/or in the money management industry. Students and scholars may also appreciate a very compact overview of most themes that relate to green equity investing.

1.2 Foreword

The output of academic research linked to the broad topic of sustainability is growing exponentially. The reason behind this dynamic is patent: the durable negligence of resources (both natural and human) is increasingly perceived as an unstoppable threat to economic, cultural and social activities. This rising awareness is spreading at many levels and through diverse channels. In particular, investors are increasingly concerned with these issues and their preferences are shifting: environment, social and governance (ESG) preoccupations have become ubiquitous in the money management industry.1 Concomitantly, firms, because they genuinely believe in sustainability, or because they want to attract capital, also bend some of their corporate policies toward green or social goals.

This trend stands in sharp contrast with Milton Friedman’s 1970 claim that “The Social Responsibility of Business is to Increase Its Profits” (which is the title of a short article in the New York Times magazine - see M. Friedman (1970)).2 The arguments in the paper are subject to interpretation (see O. Hart and Zingales (2017)) and must be contextualized (Austin (2020)), but it is undeniable that the discussions around corporate social responsibility (CSR) have since then spawned a rich and sometimes passionate debate.3 Cyert and March (1963) is often cited as a foundational work on the topic. The authors advocate that firms should take into account all stakeholders and not only maximize value for the shareholder. The resulting and rapidly expanding literature, stemming both from scholars and practitioners,4 is notoriously hard to survey. As Nath (2021) (p. 194) puts it: “SRI evolved from having a simple definition to a more complex concept embodying heterogeneity in terminology, definitions, strategies and practices.”

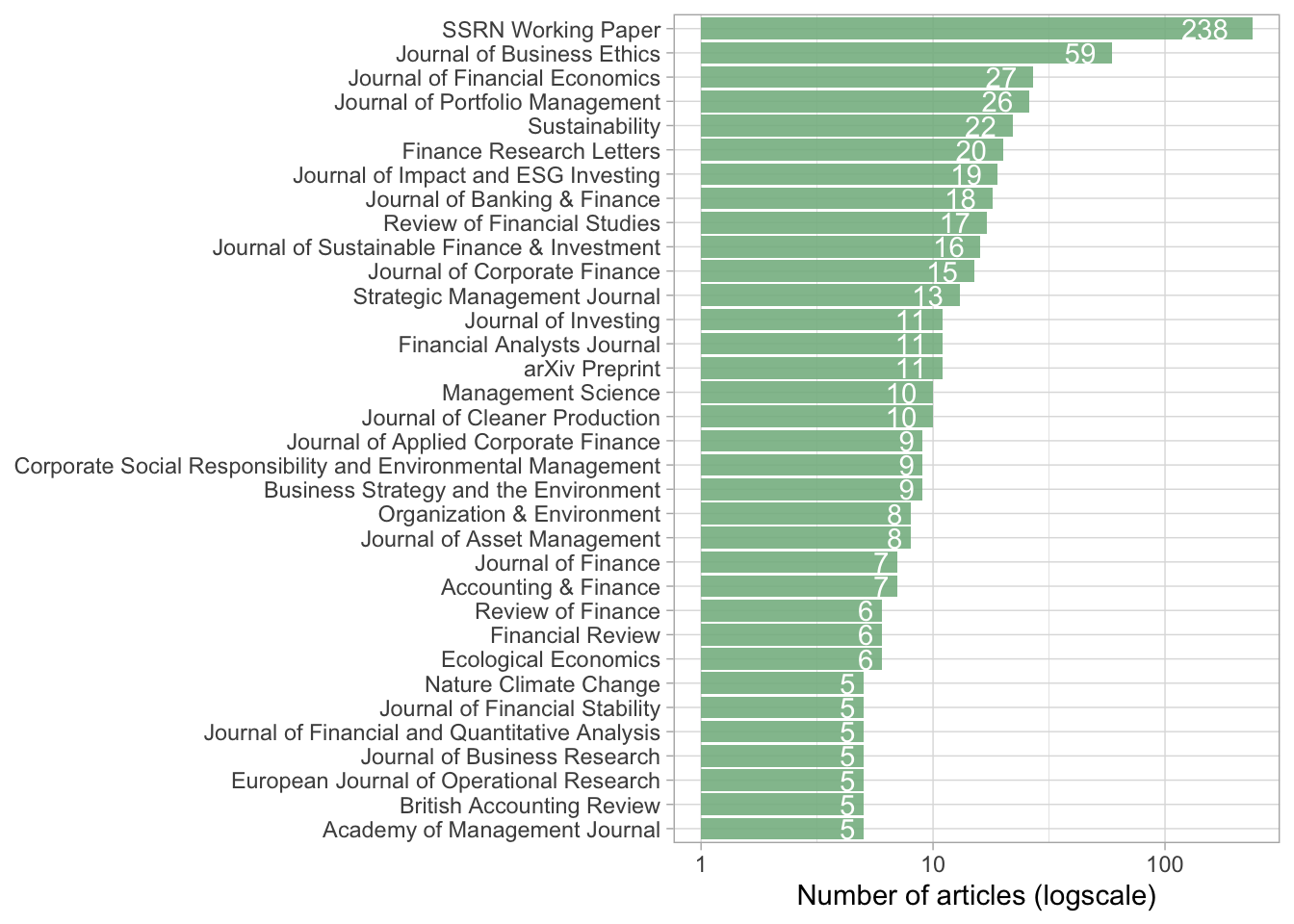

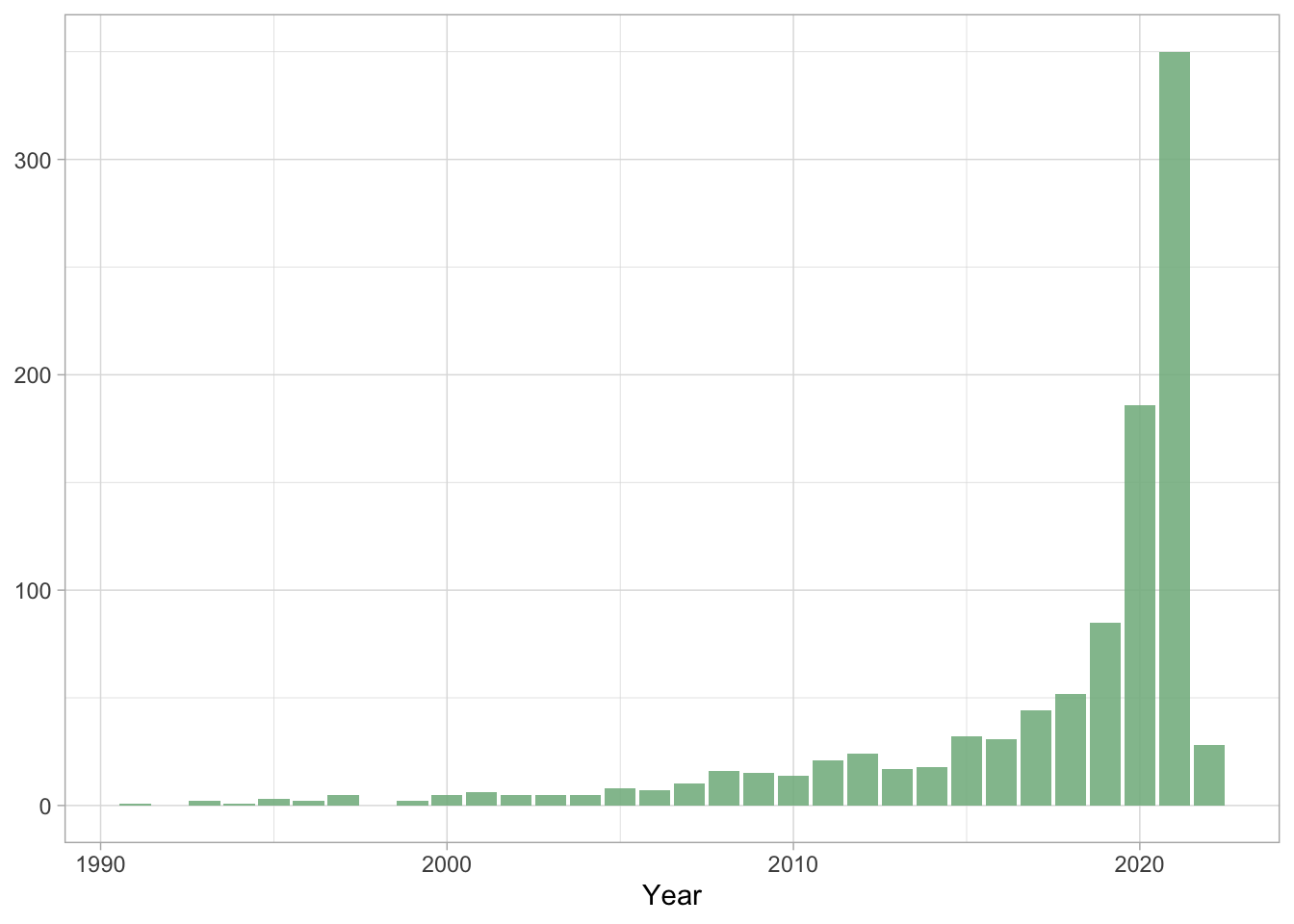

The organization of the book is intended to make it useful to researchers or practitioners (e.g., quantitative analysts, or portfolio managers) who seek references on a particular subfield of socially responsible investing (SRI) - or who want to make sure their own literature review is not missing important or relevant references. The survey is focused on the equity investment space, while other asset classes (e.g., green bonds or sustainable real estate) are out of the scope of the present compilation. One of its intentions is to leave room for recent contributions, hence it incorporates many working papers (consequently, this implies heterogeneity in the quality of the references). In Figures 1.1 and 1.2, we show the outlets which we cite most often (by numbers of papers) as well as the dynamic in publication dates. Whenever an unpublished manuscript could be found on the Social Science Research Network (SSRN), we picked SSRN as the journal affiliation by default, which explains its prominence in the graph below.

# The code below extracts data from bib file and plots journal counts

library(tidyverse) # Package for data wrangling

df <- read_delim("bib.bib", delim = "@") # Read bib file

df_book <- df[,2] %>% # From names:

na.omit() # Remove missing points

colnames(df_book) <- "type" # Change column names

df <- df[,1] %>% # From publication types:

na.omit() %>% # Remove missing

filter(length(`...1`)>1) %>% # Keep long types

mutate(X1 = substr(`...1`, 3, length(`...1`))) # Remove first 2 characters

df <- strsplit(df$X1, "=") # Split types before/after "="

df <- df %>% unlist() # Switch to dataframe

jour <- which(df == "journal") # Focus on journals only

jour <- df[jour+1] # Index of journals

jour <- str_replace_all(jour, ",", "") # Remove commas

jour <- str_replace_all(jour, "\\{", "") # Remove brackets {

jour <- str_replace_all(jour, "\\}", "") # Remove brackets }

jour <- data.frame(jour = jour) # Create dataframe

jour %>% # Long pipe that creates plot

group_by(jour) %>% # Group by journal

summarise(n = n()) %>% # Count

mutate(jour = str_remove(jour, "\\\\")) %>%

filter(n > 4) %>%

ggplot(aes(x = reorder(jour, n), y = n)) +

geom_col(fill = "#86B991", alpha = 0.9) +

theme_light() +

coord_flip() +

scale_y_log10() +

theme(axis.title.y=element_blank()) +

geom_text(aes(label = n), hjust = 1.5, color = "white") +

ylab("Number of articles (logscale)")

FIGURE 1.1: Articles per journal.

The survey encompasses 963 articles, 35 books, 9 book chapters and 3 technical reports.

# The code below plots the evolution of publication intensity

year <- which(df == "year") # Extract year data

year <- df[year+1] # Index of year

year <- str_replace_all(year, ",", "") # Remove commas

year <- str_replace_all(year, "\\{", "") # Remove bracket

year <- str_replace_all(year, "\\}", "") # Remove bracket

year <- data.frame(year = as.numeric(year)) # Convert to dataframe

year %>% # Piping flow for the plot

group_by(year) %>% # For each year...

summarise(n = n()) %>% # ... count the # of instance

filter(year > 1989) %>% # Keep only > 1989

ggplot(aes(x = year, y = n)) + geom_col(fill = "#86B991", alpha = 0.9) +

theme_light() + theme(axis.title.y=element_blank()) + xlab("Year")

FIGURE 1.2: References per year.

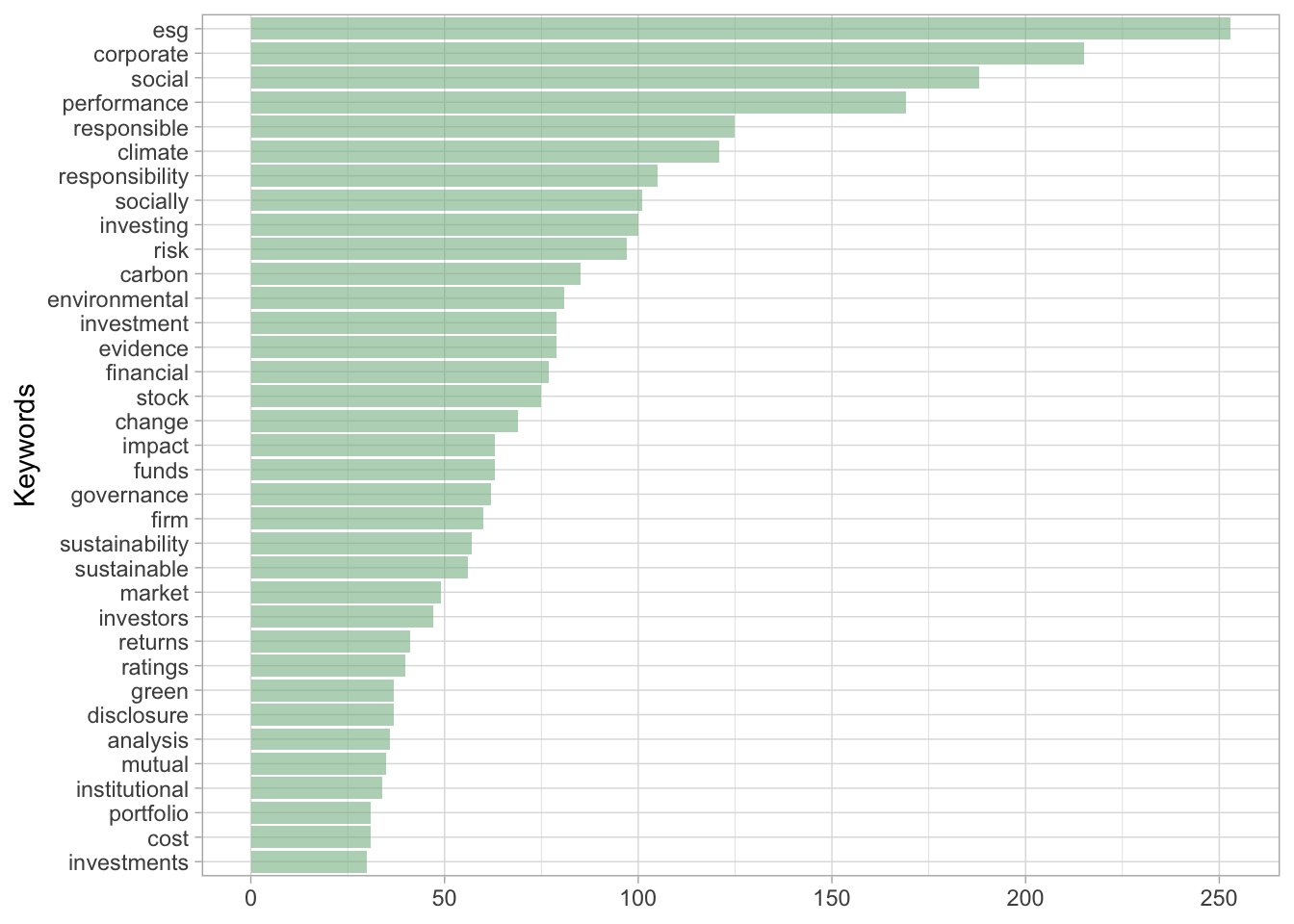

In Figure 1.3, we exhibit the most frequent words in the titles of the references.

library(tidytext) # Package for text processing

title <- which(df == "title")

title <- df[title+1]

title <- str_replace_all(title, "\\{", "") # Remove brackets

title <- str_replace_all(title, "\\}", "") # Remove brackets

tokens <- data.frame(title = title) %>% unnest_tokens(word, title)

tidy_tokens <- tokens %>%

anti_join(stop_words) # Remove stop words

tidy_tokens %>%

count(word, sort = TRUE) %>% # Count words

arrange(desc(n)) %>% # Order words

head(35) %>% # Number of words displayed

ggplot(aes(x = reorder(word,n), y = n)) + geom_col(fill = "#86B991", alpha = 0.6) +

theme_light() + coord_flip() + xlab("Keywords") +

theme(axis.title.x=element_blank())

FIGURE 1.3: Most frequent keywords in the titles of the references mentioned in the survey.

Because of the sheer quantity of work published on sustainable investing, it is sometimes imperative to make editing choices and cluster many contributions in a short amount of space. Even though it is clearly suboptimal from a qualitative standpoint, we occasionally resort to simple lists, instead of literary prose. This is meant to ease the presentation in an exercise that requires concision. Finally, throughout the book, we will resort to jargon and acronyms such as: CSI, or, corporate social irresponsibility which is less frequent than CSR, but sometimes used in studies (see Windsor (2013)), C. Kang, Germann, and Grewal (2016) and Price and Sun (2017)), corporate social performance (CSP), corporate environmental performance (CEP), and corporate financial performance (CFP).

1.3 Previous surveys and meta studies

The blossoming of ESG investing has generated a thriving literature.5 There have been several attempts to summarize and synthesize parts of it. In this landscape, because so many articles have been written on SRI, some authors have written meta-analyses on the subject. But as of 2021, there are so many meta-studies that it has almost become possible to compile a chronological meta-meta survey:

- Orlitzky, Schmidt, and Rynes (2003) find that, overall, CSP is positively correlated with CFP.

- Margolis, Elfenbein, and Walsh (2009) also document a positive effect, albeit a small one.

- Rathner (2013) concludes that, across 25 studies on socially responsible versus conventional funds, there is little evidence of outperformance in either direction.

- Endrikat, Guenther, and Hoppe (2014) compile 149 studies and conclude that CFP and CEP are generally positively linked (bidirectionally causal).

- Friede, Busch, and Bassen (2015) analyze a panel of 2,200 papers and come to the conclusion that 90% of contributions find a non-negative ESG–CFP relation (though this relation may not be significant).

- Revelli and Viviani (2015) find that investing according to CSR purposes is “neither a weakness nor a strength compared with conventional investments.”

- Hang et al. (2018)- build a large dataset of studies on the CEP-CPF relationship. They perform panel regressions to explain the variations across different variables: countries, GDP, firm size, industries, etc. They find that economic development and legal systems impact the link between ESG performance and firm profitability.

- Mutlu et al. (2018) study the impact of governance on firm performance in China. They indicate that board independence and managerial incentives are financially rewarded.

- C.-S. Kim (2019) builds a meta-study which reports that many articles find SRI to improve performance, but many papers also point to the opposite; the net effect is that ESG investing is hardly distinguishable from conventional investing, at least from a financial point of view.

- Whelan et al. (2021) compile 1,000 studies published between 2000 and 2015 which assess the link between ESG and financial performance. Based on 245 corporate studies, they report that positive (58%), neutral (13%) and mixed (21%) associations dominate the literature.

- Hornuf, Yüksel, et al. (2022) analyze 153 studies and conclude that SRI does not outperform nor under-perform the market portfolio.

In addition to meta-studies, researchers have written thematic reviews. We cite a few of them below in chronological order. The overview of Schueth (2003) provides historical insights on the development of SRI. Beal, Goyen, and Philips (2005) review various reasons why individuals may be driven towards ethical investments. Renneboog, Ter Horst, and Zhang (2008a) survey various topics, such as regulatory issues, drivers of CSR, and performance of ESG portfolios. An exhaustive list of channels that positively link environmental and economic performance is provided in Ambec and Lanoie (2008). Van Beurden and Gössling (2008), Clark and Viehs (2014) and Malik (2015) focus mostly on the CSR-CFP relationship (i.e., on the value-enhancing potential of CSR). Hoepner (2009) provides a graphical representation (via clusters) of the SRI literature. Chegut, Schenk, and Scholtens (2011) review best practices for ESG investing. Kitzmueller and Shimshack (2012) cover fundamental questions about CSR: why it exists and whether it should exist at all.

Some impacts of SRI are listed in the early review of Wagemans, Koppen, and Mol (2013). The survey of Stephenson and Vracheva (2015) focuses on the subtopic of tax avoidance in relation to SRI. G. Gianfrate, Schoenmaker, and Wasama (2015) concentrate their analysis on the relationship between sustainability and the cost of capital (see Cantino, Devalle, and Fiandrino (2017) for the link with capital structure). On the particular topic of carbon data disclosure, Hahn, Reimsbach, and Schiemann (2015) provide a tour of the literature prior to 2015. For sustainable disclosure more generally, we point to Adedeji, Popoola, and Tze (2017) and Nwachukwu (2021). The paper by Hjort (2016) exhaustively compiles topics related to climate risks in financial markets (a more up-to-date survey focused on transition risks in Semieniuk et al. (2021)). Hvidkjær (2017) gives a synthetic view of the state of research in ESG investing but concludes that “the most consistent finding in the current review is that sin stocks exhibit outperformance.” Brooks and Oikonomou (2018) provide a general purpose review of themes associated with CSR and investments. It is probably the closest in spirit to the present study (along with Piu (2020)).

Slightly more recently, the particular topic of impact investing is treated in Agrawal and Hockerts (2019b). Chatzitheodorou et al. (2019) propose a mapping of SRI types and investors motivations. Brakman Reiser and Tucker (2020) survey the landscape of ESG funds: themes, strategies, fees, and voting patterns. Talan and Sharma (2019) propose a classical survey on SRI and identify a few research gaps. Daugaard (2020) provides a recent review that identifies five emerging and trending themes: the human element, climate change, fund flows, fixed income and the rise of non-Western players. Liang and Renneboog (2021) and Billio et al. (2022) cover topics such as conceptual definitions of CSR, measurement of ESG indicators, credit risk, debt and equity costs, and finally performance of ESG-driven products (equity portfolios and green bonds).

Lately, Camilleri (2020) surveys recent trends of SRI, while Schanzenbach and Sitkoff (2020) focus on legal and conceptual aspects,6 and Meuer, Koelbel, and Hoffmann (2020) explore all the definitions of corporate sustainability proposed by the literature. Giglio, Kelly, and Stroebel (2021) and Tokat-Acikel et al. (2021) explore the links between climate change and financial markets (across several asset classes). Likewise, Breitenstein, Nguyen, and Walther (2021) review practices in environmental hazard mitigation and their impact on the financial sector. In the US market, regulatory perspectives linked to the Employee Retirement Income Security Act (ERISA) are provided by Feuer (2020) and B. S. Sharfman (2020). A discussion on the comparison with the European equivalent (Institutions for Occupational Retirement Provision - IORP II) is outlined in Daniels, Stevens, and Pratt (2021). This matters because individual savings can be nudged toward (or away from) sustainable investments, thereby shifting aggregate demand substantially. Marshall, Nguyen, and Visaltanachoti (2021) provide a very clear review of the impact of carbon dioxide emissions on financial markets.

Finally, Kuchler and Stroebel (2020) summarize the field of contributions which link social interactions and financial decision making, and Barroso and Araújo (2021) map and reveal the links (citations) between important papers in the literature. Borghei (2021) surveys the literature on carbon disclosure. Gillan, Koch, and Starks (2021) compile the contributions in corporate finance and X. Chang et al. (2022) those published in 2000-2021 in the top 5 finance journals.

See, e.g., CNBC’s report, The Rise of ESG Investing.↩︎

Surprisingly, maximizing profitability may sometimes be beneficial from a social point of view - see D. Green and Roth (2020)↩︎

Technically, it is hard to date the origins of socially responsible investing (SRI). We refer to Townsend (2020) for a historical perspective on the matter.↩︎

Recently, the Portfolio Management Research umbrella even created a dedicated outlet: the Journal of Impact and ESG Investing. Meanwhile, the Journal of Sustainable Finance & Investment is in its tenth year, and its contributions are reviewed with a bibliometric lens in Alshater, Atayah, and Hamdan (2021).↩︎

The present survey focuses on research articles, but many books have been written or edited on this subject. Here are a few in chronological order: Domini (2001), Camejo and Aiyer (2002), Little (2008), Krosinsky, Robins, and Viederman (2011), Krosinsky and Robins (2012), Gollier (2017), Boubaker, Cumming, and Nguyen (2018), Schoenmaker and Schramade (2018), Sherwood and Pollard (2018), Sachs et al. (2019), Bryant (2020), Edmans (2020), J. Hill (2020), Bril, Kell, and Rasche (2020), Esty and Cort (2020), Taticchi and Demartini (2020), Ziolo (2020) (a collection of thematic chapters), Lukomnik and Hawley (2021), Silvola (2021) and Câmara and Morais (2022) (another collection of chapters).↩︎

We also refer to Fama (2021), in which the topic of CSR is discussed from a contracting perspective.↩︎