3 Investors and SRI

This chapter is dedicated to investors: what their preferences, beliefs and practices may be, and how these have changed recently. On the narrower topic of institutional investors, we recommend the well-documented surveys of P. Matos (2020) and Crifo, Durand, and Gond (2019) (for a focus on France in the latter).

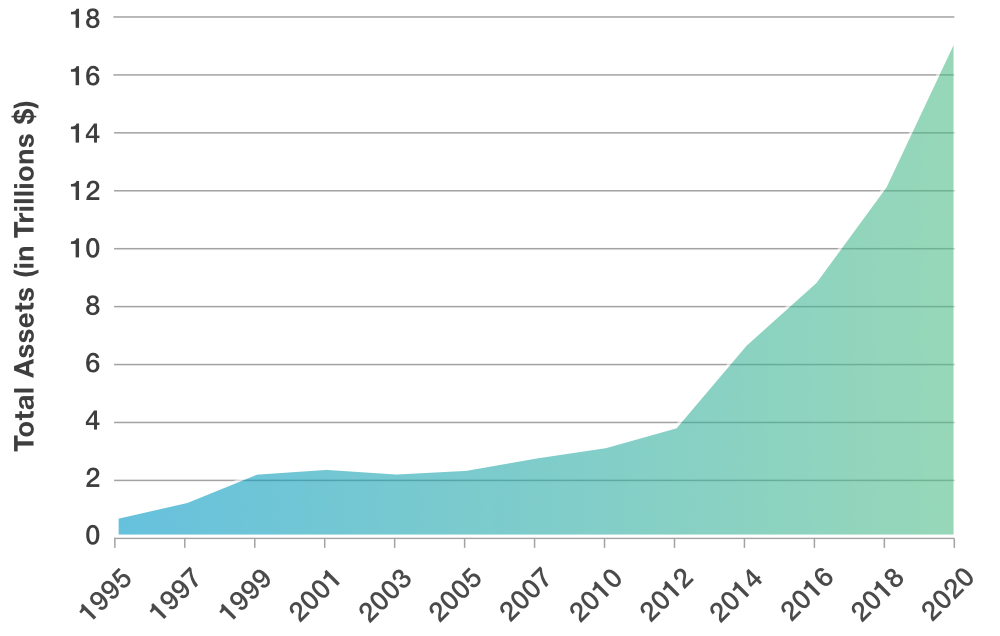

To illustrate the growing appetite of investors for ESG assets, we plot in Figure 3.1 the value through time of assets considered to belong to ESG criteria in the US. The recent steep increase mirrors and echoes that of Figure 2.1. In order to quantify the aggregate appetite for sustainable firms and funds, Briere and Ramelli (2021a) develop a green sentiment index by calculating monthly abnormal flows into environmentally friendly exchange traded funds (ETFs). The recent pronounced taste for green assets stands in sharp contrast with the offering of traditional indices: Cosemans and Schoenmaker (2022) show that many ETFs in Europe and the US have very high carbon intensities and biases.

FIGURE 3.1: Evolution of ESG assets under management. (US SIF Foundation (Forum for Sustainable and Responsible Investment). Via: Report on US Sustainable and Impact Investing Trends 2020

3.1 Investor preferences and beliefs

A central question in SRI is: why do people allocate to ESG-driven assets?13 The simplest answer is that asset owners care not only about pure profitability, but also about their ESG footprint. A more complete answer is that there are two separate reasons: \[\text{Socially responsible investors are driven by} \left\{ \begin{array}{ll} \text{social/environmental good} \\ \text{pecuniary incentives} \end{array} \right.\] The first reason is straightforward and corresponds to the case where the investor has ethical concerns and genuinely cares about the future state of the world. The second motivation can have several roots. For many reasons, sustainable firms can be perceived as less risky and/or more profitable in the long run (see C. S. Fernando, Sharfman, and Uysal (2017)). It is often assumed that firms with high ESG scores (especially high E scores) are hedges against climate related risks (see Chapter 6. Also, they may benefit from more favorable tax dispositions, compared to brown companies. The (possibly unbalanced) mixture of these two inspirations is the source of ESG investing. For investors, this can however be a source of headaches. Dual (and possibly contradictory) incentives in the ESG versus performance dimensions complicate the task of attracting flows (see Gantchev, Giannetti, and Li (2020)).

In fact, according to Amel-Zadeh (2021) experts and investors seem to agree that climate change is financially material, but most firms do not believe they are exposed to weather-related risks. This creates an asymmetry in the assessment of exposures which is mostly explained by the lack of data and methods that evaluate these risks. An important aspect of the matter is education: Bernard, Tzamourani, and Weber (2021) find that people who are aware of the challenges posed by climate change are more willing to pay to offset CO\(_2\) emissions.

While this section is dedicated to green investors, it is also noteworthy to fathom the characteristics of brown investors. In their study on tobacco stock ownership, Blitz and Swinkels (2021b) show that investors in tobacco stocks are on average more often anonymous, compared to investors in peer stocks.

In their experiment involving Swedish investors, Lagerkvist et al. (2020) find that fund preferences are more driven by sustainability criteria, than other characteristics (like fees, fund type, risk level, or geographical focus). According to another natural experiment carried out in Hartzmark and Sussman (2019), investors do value sustainability and derive utility both from financial returns and social returns. In a third natural experiment, Chew and Li (2021) reveal that individuals exhibit both sin stock aversion and virtue stock affinity. However, there is an asymmetry: avoiding “bad” investments matters more than investing in good (i.e., green) ones. In a choice-based experiment involving shareholders, De Villiers et al. (2021) report that the latter are willing to pay for environmental disclosure, but not for social disclosure. This shows that not all pillars are equal to some stakeholders. Using NLP, Jaunin and Terracciano (2022) document that green funds are likely to analyse earning conference calls and invest in the firms that mention sustainability.

In addition, Bollen (2007) and Barber, Morse, and Yasuda (2021) also find that investors derive non-pecuniary utility from investing in funds that are not only profitability-driven. More precisely, Mahmoud (2020) argues that SRI can be fostered by mechanisms of warm glow or self-image, or simply by personal happiness. This is a two-edged sword because, as Heeb et al. (2022) show, the so-called impact investors can be tempted to optimize this warm glow instead of their true impact per se. J. E. Humphrey and Li (2021) reveal that mutual funds reduce the carbon impact via two channels: either because they have signed the Principles for Responsible Investment (thereby bending their policies toward greener firms), or simply because they have environmentally-aware stakeholders. The recent trend does indeed confirm that mutual funds in the US have shrunk their holdings in black (carbon-intensive) asset by almost a factor 2 between 2012 and 2018 (Muñoz (2021a)). Relatedly, Alda (2021) reports that conventional firms are more and more tilting their holdings toward ESG firms so that they are slowly converging to their green counterparts.

One way to measure the aggregate appetite for SRI is to use internet search volume on this topic. Y. Chen, Kumar, and Zhang (2019) find that firms that are positively exposed to this social sentiment proxy attract higher institutional demand and earn positive abnormal returns. The COVID-19 crisis has cemented and accelerated the demand for sustainable assets and funds. For Pástor and Vorsatz (2020), sustainability has become “a necessity rather than a luxury good.” Other sources of information are company filings and Iliev, Kalodimos, and Lowry (2021) show that while investors do monitor firms’ governance, there are discrepancies because much of the focus is on large firms (this is confirmed in Azar et al. (2021)). When analyzing ESG news and fund flows, Linquan Chen et al. (2020) also find that active managers react to ESG information because they seek to cater to some of their clients’ demands.

Because ESG-driven investors are less interested by financial performance, Benson and Humphrey (2008) and Renneboog, Ter Horst, and Zhang (2011) find that SRI fund flows are less sensitive to past returns, compared to flows coming in and out of conventional funds.14 This may explain why, more and more, mutual funds compete to obtain eco-friendly certifications (Ceccarelli, Ramelli, and Wagner (2020)), if only because they are vectors of differentiation, which some funds may seek (Rankin (2020)). However, these green labels are by no means a guarantee of ex-post ESG performance by the fund portfolios (S. Kim and Yoon (2020)). One reason may be that even when CEOs are incentivized toward sustainable goals, reaching these goals may take time (Derchi, Zoni, and Dossi (2021)).

Another reason why institutions turn to SRI comes from their customers or other stakeholders (Majoch, Hoepner, and Hebb (2017)). Amel-Zadeh and Serafeim (2018) show that beyond performance, investors resort to ESG because of client demand and product strategy (see also Jagannathan, Ravikumar, and Sammon (2018)). Finally, environmental awareness and financial performance may be linked, because, as Cormier and Magnan (1997) explain, investors are afraid that polluting companies will be sanctioned, thereby incurring a financial cost and lowering returns. Indeed, because of climate change risks (see Chapter 6), investors anticipate more regulatory constraints in favor of the environment, which will negatively impact the most polluting firms (Ramelli, Ossola, and Rancan (2021)). One such example is the carbon tax which can be quite costly for some industries (Bertolotti and Kent (2019), Carattini and Sen (2019)).

Since green investors ask less return for firms that make efforts toward sustainability, SRI is found to be negatively related to cost of equity (M. P. Sharfman and Fernando (2008), El Ghoul et al. (2011) - see also Section 4.7. Similarly, Chava (2014) find that investors demand significantly higher expected returns on stocks excluded by environmental screens. Likewise, Stotz (2021) finds that discount rates of high-ESG stocks have fallen relative to low-ESG stocks, so that high ESG stocks have higher realized returns, but lower expected returns. One reason for that, as Davis and Lescott (2019) argue, is that all other things equal, a firm with lower ESG scores has riskier cash flows, which pushes its cost of capital up. Indeed, some stockholders view ESG-driven firms as more resilient (Roselle (2016)).

The inclination toward sustainability can further be elucidated from social perspectives (Hoepner, Majoch, and Zhou (2019)). According to Riedl and Smeets (2017), investors hold socially responsible mutual funds because of social preferences and social signalling. Typically, Democrats hold sin stocks in smaller proportions, compared to Republicans (H. Hong and Kostovetsky (2012)), and Republican shareholders are related to firms with lower environmental performance (I. Kim, Ryou, and Yang (2020)).15 Investors who view CSR as beneficial to society naturally tend to favor ESG firms (Arnold et al. (2020)). Local pollution is also found to be a driver of investors’ preference: Huynh, Li, and Xia (2021) find that managers who live in polluted areas tend to underweight firms with high emissions in their portfolios.

Religiosity also seems to be positively correlated with the propensity to invest in sustainable companies (John Bae, Sun, and Zheng (2019)), or to the propensity toward ESG disclosure (see the study of Terzani and Turzo (2021) which operates at the country level and Muñoz (2021b) for a discussion on sin sectors). Some mutual funds are even dedicated to religion-based SRI (see Stultz (2020)). Relatedly, Glac (2012) finds that the integration of investment frames (i.e., when social beliefs are important in the investment domain) are positively correlated with propensity to indulge in SRI. In a similar vein, norm-constrained institutions such as pension plans are less likely to hold sin stocks, compared to mutual or hedge funds (H. Hong and Kacperczyk (2009)). Overall, peer effects, such as those uncovered in Karakostas, Morgan, and Zizzo (2021) are probably at play in the propensity to invest in green assets.

What are some other characteristics of ESG investors? Cojoianu, Hoepner, and Lin (2021) find that impact investors tend to be younger and often invest in cleantech and education (plus in agriculture in Europe and Africa). J. E. Humphrey, Warren, and Boon (2016) contend that green asset managers are more likely to be women and have longer tenure than conventional managers. However, differences in skill are not meaningful. In their study on retail investors, D’hondt, Merli, and Roger (2021) reveal that age, gender, risk tolerance and financial literacy help explain exposure to the E, S and G pillars, but that the effects can be pillar-dependent. For instance, gender is only prevalent for the G pillar. M. Bianchi, Wang, and Liu (2022) show that economic as well as non-economic factors explain either how individuals trade, or how they change the way they do. The factors include: growing up in a region with more pro-social values, being exposed to pollution or to natural disasters.

SR investors are also more loyal: Bollen (2007) finds that investor cash flow volatility is lower for SRI funds than for conventional mutual funds. There are also mimicking effets: Hellström, Lapanan, and Olsson (2020) find that parents’ and children’s SRI behavior are correlated. J. Humphrey et al. (2021) document asymmetries in preferences: individual investors are more inclined to avoid negative ESG externalities than they are to embrace the positive externalities.

While mutual funds have been active drivers of SRI, ESG-based private equity is now also thriving (Indahl and Jacobsen (2019), Zaccone and Pedrini (2020), Alfonso-Ercan (2020) and Long and Johnstone (2021))16. This is also true for venture capital and we refer to Block, Hirschmann, and Fisch (2020) and Barber, Morse, and Yasuda (2021) for studies on the preferences of impact investors targeting young companies. However, appetite for SRI is not restricted to institutional investors. Barreda-Tarrazona, Matallı́n-Sáez, and Balaguer-Franch (2011), J.-B. Kim, Li, and Liu (2018), Mariacristina Rossi et al. (2019) and Bauer, Ruof, and Smeets (2021) document a recent increase of interest from households and retail investors. Individuals are indeed sensitive to non-financial data when crafting investment decisions (Mervelskemper (2018)). However, they do not process the ESG information like institutional investors (Pelizzon, Rzeznik, and Weiss-Hanley (2021)).

Shareholders are increasingly worried about the impact of climate change (see also Chapter 6). According to Krueger, Sautner, and Starks (2020), investors believe climate change will have repercussions on equity valuations which should be hedged via risk management and engagement. This is true irrespective of the political environment. Ramelli et al. (2021) report that even under the (rather polluter friendly) Trump administration, investors continued to reward sustainable firms.17 However, as is noted in Chapter 2, the lack of homogeneity and transparency in ESG reporting makes it hard to accurately assess firms’ social and carbon footprints. Ilhan et al. (2021) report that many investors “think climate risk reporting to be as important as traditional financial reporting and that it should be mandatory and more standardized.”

We end this section by underlining the importance of nudging in SRI. Briere and Ramelli (2021b) document the significant impact of offering a sustainable investment option in employee saving plans (in France). Naturally, providing the option of choosing a sustainable fund increases the participation of retail investors to the green finance movement.

3.2 Impact investing

Another focal question in SRI is the effect that it has on corporations’ policies and, in turn, on the social sphere.18 There is some disagreement in the literature on whether investors are able to influence corporate policies efficiently. For instance, Coffey and Fryxell (1991) report positive impacts with respect to gender parity, but no influence on charity giving. Using institutional holdings combined to a sophisticated demand estimation technique, Noh and Oh (2021) find that investors are able to put pressure on firms – willingly or not. This institutional pressure for greenness is positively linked to firms’ future environmental performance. Relatedly, Dikolli et al. (2021), in their study on close to 4,000 shareholder proposals, conclude that ESG mutual funds are more likely than non-ESG mutual funds to support environmental and social (E&S) shareholder proposals.

In contrast, David, Bloom, and Hillman (2007) conclude that shareholder activism may in fact be counter-productive and lead to opposite effects. In Cohen, Gurun, and Nguyen (2020), the authors show, that paradoxically, brown firms are much more invested in green R&D, especially in the oil and gas industries. Thus, screening them out of ESG portfolios is not supportive of sustainable research and patenting. In addition, few so-called “impact funds” tie the compensation of their managers to the (blurry) notion of impact. The incentives are thus not aligned with the purpose of the funds, and the measurement of their impact is often foggy.19 What’s worse, Groot, Koning, and Winkel (2021) show that portfolio managers predominantly vote against social and environmental proposals. Even those who adhere to the Principles for Responsible Investment are not inclined to support green policies. One possible reason is that asset managers are not accustomed to analyze non-financial data (Arjaliès and Bansal (2018)), or may be confused by it (Pelizzon, Rzeznik, and Weiss-Hanley (2021)). This is of course less and less plausible, as investors are increasingly concerned with ESG issues. Serafeim and Yoon (2021b) find that investors react to ESG news, especially if the latter relate to social capital and are susceptible to impact a firm’s fundamentals. Overall, this resonates with a warning from the theoretical paper by Yan, Ferraro, and Almandoz (2019) which warns that “the relationship between the dominant financial logic and the social logic of SRI shifts from complementary to competing as the financial logic becomes more prevalent in society and its profit-maximizing end becomes taken for granted.”

The middle ground (see Simerly (1995) and Heath et al. (2021) for instance) establishes that investors do not significantly impact corporate policies, or that the impact is contingent on investor type (hedge fund, bank, mutual fund; see R. A. Johnson and Greening (1999)). In Blitz, Swinkels, and Zanten (2021) it is found that even though sustainable investing increases green firms’ access to capital, it does not (yet) limit funding opportunities for non-sustainable companies. Also, success of shareholder activism may be conditional on some favorable factors. Barko, Cremers, and Renneboog (2021) document that activism is “more likely to succeed when targets have a good ex ante ESG track record, lower ownership concentration and growth.”

The recent trend of research seems to nonetheless establish some effect. It may be direct: large shareholders command20 that the firm enforces sustainable choices (lower carbon emissions, development of environmentally friendly products, board gender parity (see Ghosh et al. (2016)).21 Other repercussions are indirect: witnessing the money flows toward SR firms, executives may be inclined to orient their policies to match ESG goals so as to capture some of these flows, or to improve the media coverage of their companies (Cahan et al. (2015)).22 In fact, it has been shown (M. Kang et al. (2021)) that signalling sustainability is one way to increase capitalization: when firms are included in green indices, the demand stemming from investors increases, which pushes prices up. Reversely, controversies reduce the odds of being included in green indices (Arribas et al. (2021)). In addition, negative media coverage pertaining to sustainability increases the chances of CEO ouster (Colak, Korkeamaki, and Meyer (2020), Burke (2021)), which incentivizes the top management to act responsibly. We refer to Gillan and Starks (2000), Gillan and Starks (2007), Goodwin (2016), Zeng and Strobl (2016) and Gomtsian (2020) for studies on shareholder activism and the role of institutional investors. L. Bebchuk and Hirst (2019) reviews the impact of index funds on corporate governance.

Kölbel et al. (2020) review the mechanisms of SRI’s impact. They list three channels (shareholder engagement, capital allocation, and indirect impacts) but notice that only the first one is well supported by the literature. One such contribution is the work of Dyck et al. (2019) which shows that “institutional investors transplant their social norms regarding E&S issues throughout the world.” The authors find that these investors care more about ESG after-shocks that reveal how valuable sustainability is (e.g., market crashes or climate-related disasters). Z. F. Li, Patel, and Ramani (2020) find two practices that mutual funds use to impact firms’ ESG policies: voting and CEO compensation (i.e., ESG incentives).23 Their findings are more marked when board governance is strong and when the funds hold significant shares of the companies. Governance is often key. Saeed et al. (2021) find that CSR governance is an efficient driver of reductions of carbon emissions.

A related stream of the literature pertains to ownership. Shive and Forster (2020) document that public firms owned by mutual funds have lower carbon emissions. Kordsachia, Focke, and Velte (2021) find that sustainable institutional ownership (measured by the signatory status to the UN Principles for Responsible Investment) is positively associated with a firm’s environmental performance. In addition, Cox, Brammer, and Millington (2004), Neubaum and Zahra (2006) and H.-D. Kim et al. (2019) find that the relationship between institutional ownership and ESG outcomes is more salient when the investment horizons increases (and, as McCahery, Sautner, and Starks (2016) show, investors intervene more when they have long-term perspectives). Similar results are derived in Boubaker et al. (2017), Starks, Venkat, and Zhu (2020), J.-B. Kim, Li, and Liu (2018) and Gloßner (2019). In contrast, short-term investors tend to prefer polluting firms (Tirodkar (2020)), and they have the most influence on firm values because they discipline managers through credible threats of exit (Döring et al. (2021)).

The effectiveness of environmental activist investing is nonetheless still debated. Naaraayanan, Sachdeva, and Sharma (2021) report that targeted firms end up reducing their toxic releases, greenhouse gas emissions, and cancer-causing pollution. Some researchers however are less optimistic about the ability of SRI to impact companies’ policies. Blitz and Swinkels (2020) contend that excluding unsustainable stocks from portfolios does not contribute to making the world a better place because the corresponding firms are then owned by investors who do not care about ESG issues (and thus do not bend corporate policy towards sustainable objectives). One example is detailed in Fu, Lin, and Zhang (2020), where it is shown how ESG-driven shareholders can impact the gaming industry. Also, ESG concerns must be shared both by shareholders and top management. When the latter is not supportive of ESG policies that the former push, firms may be negatively impacted by negative incidents (Yazhou He, Kahraman, and Lowry (2020)), the latter being taken into account by analysts when they update their earnings forecast (Derrien et al. (2021)). Finally, DesJardine, Marti, and Durand (2021) find that activist hedge funds are a threat to sustainability because the targeted firms end up curtailing SR policies. In fact, the complexity of ownership structure may sometimes blur our ability to understand which investors own shares and voting risk in brown firms (Mizuno et al. (2021)).

An important study is that of Rohleder, Wilkens, and Zink (2022). In this article, the authors build an index that captures the decarbonizing selling pressure (DSP). It is built on decarbonizing trades, i.e., trades that 1) sell the 5 dirtiest positions of the fund in terms of carbon intensity (CI = emissions divided by sales) and 2) lead to a decrease in the weighted average CI of the fund. This measure aggregates the shift in position of all funds considered in the study. The authors find that DSP from mutual fund decarbonization is associated with negative subsequent returns. Thus, it does seem that institutional investor exert pressure on firms and the resulting prices declines are both strong and long-lasting. Subsequently, it is shown that divested firms, which experience such a stock price deterioration, reduce their emissions on average compared to non-divested firms.

Nevertheless, other channels may also be at work. Indeed, R. Dai, Liang, and Ng (2021) find that corporate customers can impact the CSR policy of their suppliers. Large buyers, because they are strong drivers of business, have some power to curb their suppliers’ behaviors. These buyers do not want to take the risk of bad publicity stemming from an association to a faulty partner. The reverse effect, whereby suppliers affect the risk of their clients is documented in H. A. Chen, Karim, and Tao (2021). Though not yet documented in the literature, these phenomena are probably amplified by the importance of social networks. One example of a social movement that impacted SRI in France is documented in Arjaliès (2010). Retail customers are also sensitive to ESG-driven companies (Radhouane et al. (2018)).

We end this section with a single number. Berk and Binsbergen (2021) prove an approximate formula for the impact of impact investors on the cost of capital of firms. The difference in cost of capital with and without socially responsible investors is found to be equal to \(\mu f(1-\rho^2)W_e/W_{-e}\), where \(\mu\) is the market risk premium, \(f\) is the proportion of the economy that is targeted by the investors, \(\rho\) is the correlation between green and brown firms, and \(W_e\) and \(W_{-e}\) is the wealth dedicated to green investments versus the rest of the wealth. The authors, with historical figures, find that this number equals 0.35 basis points because \(W_e\) is only about 2%. This number is therfore too small to impact real investment decisions.

3.3 Investor practices

Once the decision is taken to invest in green firms, one question remains: how? While there are many ways to proceed qualitatively and quantitatively (see Mooij (2017a) as well as Chapter 5), we briefly mention some simple routines below. In their survey of investor practices, Van Duuren, Plantinga, and Scholtens (2016) show that practitioners use ESG data for red flagging and risk management. In another such survey, Eccles, Kastrapeli, and Potter (2017) report that practitioners use ESG data essentially for screening purposes or best-in-class selection. This is confirmed in Cox, Brammer, and Millington (2004) as well as in Hoepner and Schopohl (2018) for two very large institutional investors. In addition, they conclude that one of the main arguments for ESG investing is that it helps foster a long-term investment mindset.

According to Dorfleitner, Kreuzer, and Laschinger (2021), highly remunerated asset managers have an asymmetric posture with respect to sustainability. While they react rapidly to controversies (and avoid firms hit by scandals), they are much less pro-active with respect to corporate green initiatives. Nevertheless, as is outlined in Rhodes (2010), screening can be hard to perform efficiently.

We end this section with a pot-pourri of practices described in the literature. J. R. Nofsinger, Sulaeman, and Varma (2019) report that investors underweight stocks with negative E&S indicators, likely because they associate negative E&S scores with downside risk. Moss, Naughton, and Wang (2020) find that retail investors do not respond to ESG disclosures, in contrast to institutional investors, who seem to do. Berry and Junkus (2013) show that investors seem to prefer best-in-class to negative screening, thereby rewarding green firms but not penalizing unsustainable ones. Matallı́n-Sáez et al. (2021) study investor flows in and out of mutual funds. They find a striking pattern. For conventional funds, outflows correlate negatively with past performance (e.g., losses are penalized, which increases outflows, gains are rewarded, which reduces them). For socially responsible funds, it is the opposite: investors hold on to green funds that have underperformed.

S. Kim and Yoon (2020) introduce the notion of fake ESG investing, that is, when some fund tries to attract capital via ESG labelling but fails to improve its ESG footprint afterward.

Atz et al. (2019) propose a five-step methodology to assess what they call ROSI (return on sustainability investments). The steps start by identifying strategies and actions and end by monetizing and evaluating their consequences.

Finally, according to Adriaan Boermans and Galema (2020), investors are subject to home bias. When they originate from countries with many carbon-intensive firms, their portfolios are logically more exposed to such types of firms.

3.4 Does SRI work?

[This section is under construction]

One of the most important question in SRI pertains to its efficiency. Below, we list a few results which we will organize some time in the future:

- Gantchev, Giannetti, and Li (2022) find that E&S incidents are followed by small divestitures and that firms with high E&S-orientated ownership subsequently decrease their GHG emissions and improve their E&S scores.

- Edmans, Levit, and Schneemeier (2022) propose a theoretical model of socially responsible divestment. In short, sustainable investing can only have an impact if green shareholders have enough power to coerce top management and incite decision makers to reduce negative externalities.